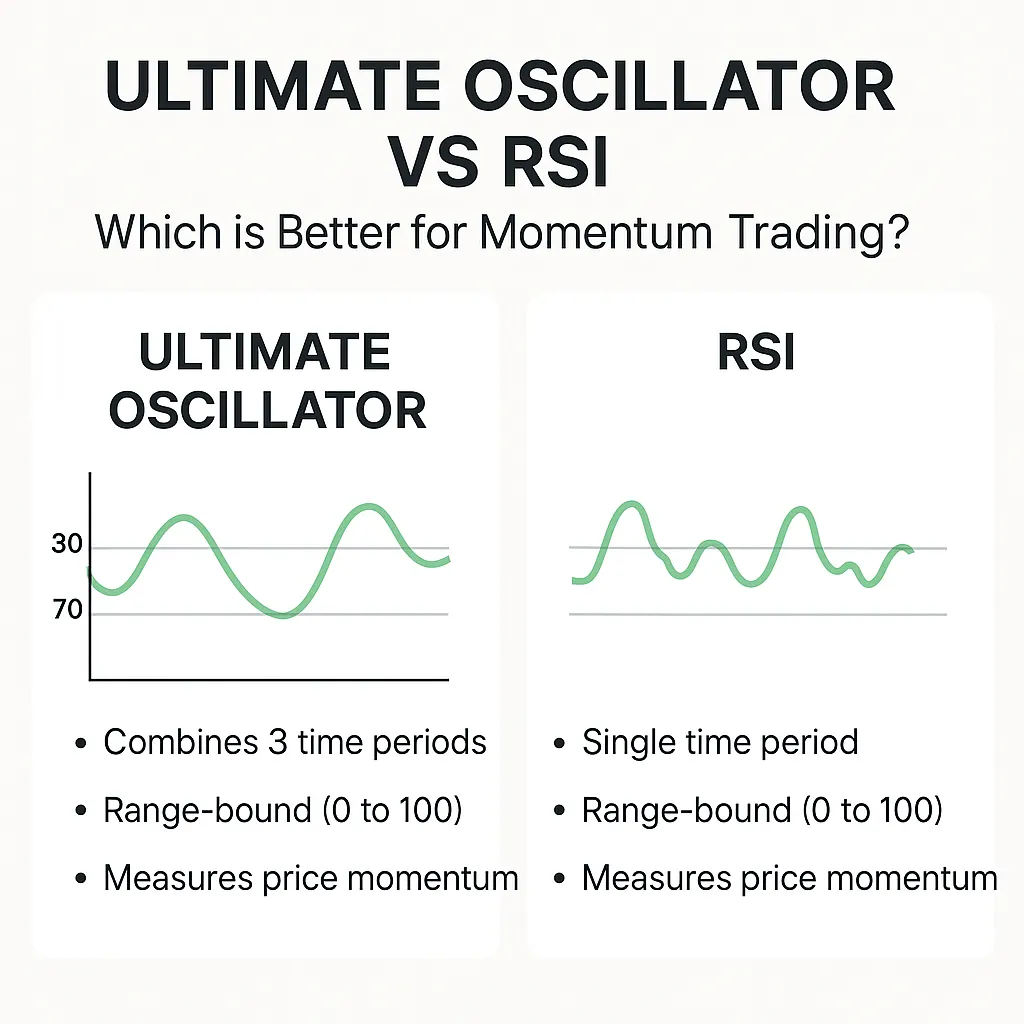

When it comes to momentum trading, two of the most popular tools are the Ultimate Oscillator and the Relative Strength Index (RSI).

Both aim to identify overbought and oversold conditions, but they work differently — and depending on your style, one may fit better than the other.

In this article, we’ll compare Ultimate Oscillator vs RSI, so you can choose the best indicator for your trading needs.

🔍 Quick Overview: Ultimate Oscillator

Created by: Larry Williams

Core concept:

The Ultimate Oscillator (UO) measures momentum across three timeframes (short, medium, long) to reduce false signals.

✅ Strong at detecting multi-timeframe momentum

✅ Reduces whipsaw moves during market noise

🔍 Quick Overview: Relative Strength Index (RSI)

Created by: J. Welles Wilder

Core concept:

The RSI measures the speed and change of recent price movements, plotted between 0–100.

✅ Great for quick detection of overbought and oversold zones

✅ Simple and easy to understand

📈 Ultimate Oscillator vs RSI: Feature Comparison

| Feature | Ultimate Oscillator | RSI (Relative Strength Index) |

|---|---|---|

| Timeframe Basis | Combines 7, 14, 28 periods | Single timeframe (default 14) |

| Type | Multi-timeframe momentum oscillator | Single-timeframe momentum oscillator |

| Signal Clarity | Moderate (needs trend context) | Very clear (70 overbought, 30 oversold) |

| Sensitivity | Moderate (balanced) | High (can be very sensitive) |

| Best Market Conditions | Trending and volatile markets | Range-bound or swing markets |

| False Signal Reduction | Good | Needs confirmation tools |

| Best Timeframes | 15-min, 1H, 4H | 5-min, 15-min, 1H, Daily |

🎯 When to Use Ultimate Oscillator

✅ You want confirmation across multiple timeframes.

✅ You trade fast-moving or trending markets like stocks, crypto, or commodities.

✅ You prefer less whipsaw during market noise.

🎯 When to Use RSI

✅ You want simple, quick signals for scalping or short-term swing trading.

✅ You trade range-bound or slow-moving markets.

✅ You prefer straightforward 70/30 signals without deep calculation.

🧠 Practical Examples

Example 1: AAPL Stock Trending Up

- UO shows strong rising momentum across periods.

- RSI also rises but reaches 70 quickly and gives early overbought warning.

Which is better?

✅ Ultimate Oscillator, because trends often continue beyond traditional overbought RSI levels.

Example 2: Sideways EURUSD Market

- Price stuck between support and resistance.

- RSI cleanly oscillates between 30–70 levels.

- UO offers mixed signals.

Which is better?

✅ RSI, because it captures short swings better.

🔥 Can You Combine Ultimate Oscillator and RSI?

Absolutely!

✅ Use RSI to spot quick overbought/oversold levels.

✅ Use Ultimate Oscillator to confirm broader trend momentum.

This combination gives you early warnings plus higher confidence before taking a trade.

🛑 Common Mistakes to Avoid

| Mistake | Correction |

|---|---|

| Trusting RSI blindly in trending markets | Confirm trend with Supertrend or UO first |

| Ignoring timeframe alignment | Always match indicator timeframe with strategy |

| Overtrading based on every signal | Focus on high-probability setups only |

✅ Final Verdict: Which Is Better?

| Style | Best Indicator |

|---|---|

| Trend-following / Momentum Trading | Ultimate Oscillator |

| Range Trading / Quick Swings | RSI |

| Combination Strategy | Both together |

👉 If you’re focused on momentum trading in trending markets, Ultimate Oscillator wins.

👉 If you’re a scalper or range trader, RSI offers faster signals.

Best advice: Master both tools and use the right one based on current market conditions!

✅ FAQs: Ultimate Oscillator vs RSI

1. Which indicator is better for intraday trading?

RSI is faster, but Ultimate Oscillator gives cleaner intraday trend confirmations.

2. Can I use both UO and RSI together?

Yes! They complement each other very well, especially in volatile markets.

3. Does Ultimate Oscillator repaint?

No. Once the candle closes, the Ultimate Oscillator value is fixed.

4. What RSI settings work best for scalping?

Lower settings like 7 or 9 periods help capture quick swings.

5. What are good UO settings for swing trading?

Stick to the standard 7-14-28 periods for smooth momentum capture.

📈 Internal Linking Suggestions:

When you post this, link to:

- Ultimate Oscillator Trading Strategies That Actually Work

- Ultimate Oscillator Best Settings for Beginners and Day Traders

- How to Use Ultimate Oscillator for Spotting Reversals